How Much Money Do I Need to Save a Week to Retire a Millionaire?

Not all of us are lucky enough to receive a fat salary check every month. There are lots of people who barely make ends meet. In other cases, people make decent money but they are so caught up in financial crises that it becomes impossible for them to save some amount for emergencies. So in a world where it is so hard to save a good sum for a rainy day, we have come up with a formula that might help you retire as a millionaire!

Normally, we consider investing or saving in percentages. The usual formula in this regard is to chip in 15% of your earnings to a retirement fund, but what if your 15% is too low to get to your targeted savings? Luckily, you have come to the right place as we are going to break it down to something you may easily relate to.

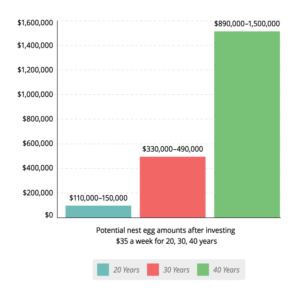

Consider a scenario where you save $35 a week and invest it in some sort of mutual fund with a good growth. This sum may be thought of as the 15% of a salary that goes somewhere around $12,000. Using that formula while working 40 hours every week, you would be able to retire with the following sums:

*estimated values

Here you need to consider the fact that annual raises are not included into this equation. You won’t be stuck at what you are making today forever. If you deliver good performance at work, you will be getting lots of increments as well. So imagine how high your total amount would be if you keep on increasing your contributions with your growing income.

But if you do not believe and you can wait for 40 whole years, it suggests that you will have to chip in everything you have in your targeted span of time. Some of the finest ideas that might help you kick your retirement savings up a notch are provided below.

Start Your Side Hustle

If you are young and energetic, it is a good idea to put in some additional efforts. Work hard and bring home more money. In case you succeed in doubling your contribution to $70 per week, you may end up having about $250,000 in 20 years and $700,000 to $1 million in 30 years.

Work for Some Additional Years

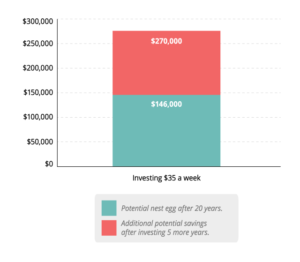

When it comes to retiring at the age of 65, there are no rules that bound you to do so. In case you are 45 and planning on building up a good retirement fund, working for 5 additional years may increase your sum from $250,000 to $270,000. All you need to do is save $35 every week.

Pay off the Entire Mortgage Sum

It seems like a huge thing but you need to focus your attention on how well you could do for your retirement fund without having to worry about a mortgage. You may have to live in a smaller house for a while but if you consider the long term results, it’s totally worth it.

In the end, we would highly recommend you to talk to a good investment professional. No matter whether you make a small or a large sum of money, talking to someone with professional experience in the area of finance and investment may turn out to be really helpful. Never hesitate to sit down with an investing pro, as the initial meetings do not cost you a dime. Consult them and ask about your possible options.

Discussions are always a good thing. Talk to people who are important in your life and go for an option that appears to be the best and safest under the circumstances.

For more interesting topics and discussions find me @thefrankmedina